Every year all individuals who made money in Korea need to file taxes. The more money you spent in certain areas, the better the chance you’ll get a refund at the end of the process. The categories include things like medical expenses, education, housing (only applicable to Korean nationals), and something called cash receipt. Most people pay for things with a credit or debit card. As those are electronic, it is easy for trace those and get credit for spending money. Cash, however, is notoriously difficult.

“Cash receipt” is a direct translation from the Korean term 현금영수증 (現金領收證, hyeongeum yeongsujeung) this is a way that people can get credit for purchases conducted in cash. When you do a purchase with cash, tell the worker 현금영수증 and then give them your phone number or your cash receipt card (현금영수증전용카드 現金領收證專用card, hyeongeum yeongsujeung jeonyong kadeu), which is an 18 digit code, if you have it.

When done correctly, the store will contact the government telling them of the purchase so you can get credit and they can properly get taxed for the sales they conducted. Keep in mind that a shady individual will not want to do this process as it means they must pay higher taxes to the government as there would now be proof of more sales. When done at a proper store, they employee will ask you to type in your phone number or cash receipt card at a keypad and press the green button marked 확인 (確認, hwagin) which can be translated as enter or confirmation.

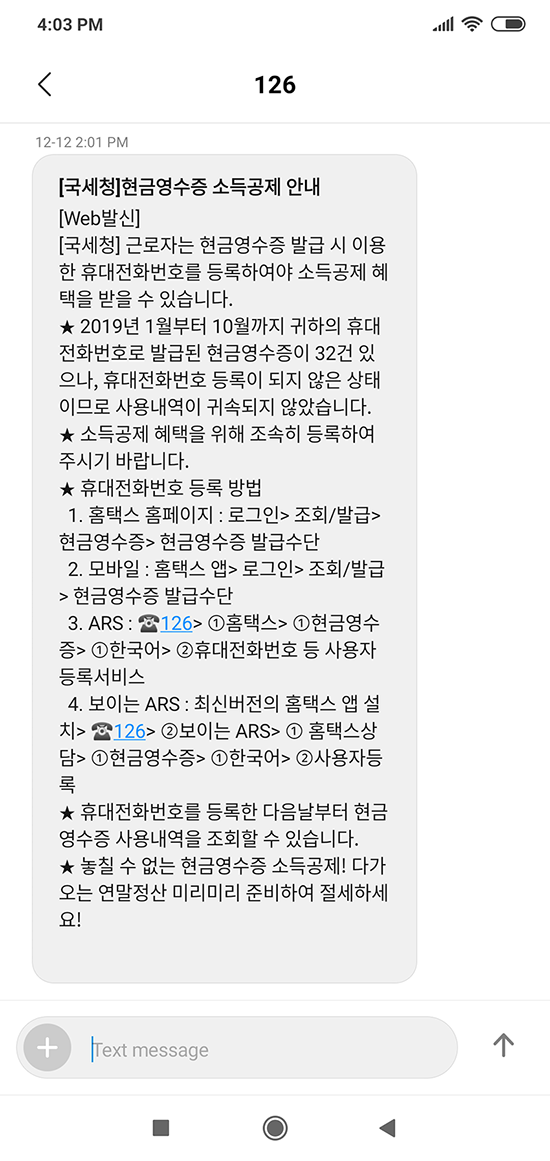

If you have not registered your phone, or if you have changed your phone and not registered it with the National Tax Service (국세청, 國稅廳, guksecheong, website), then you will probably not get credit for your cash receipts. Here is an example of a text message sent in middle December, telling the individual that they have 32 instances of cash receipts from January through October, but none of them will be counted as the phone number was (changed and) not registered with the tax office. If you want to see the words more clearly, click the picture to see a larger version of the screen capture. The text has been copy-pasted below the image, in case you wish to copy-paste it into a translation website.

[국세청]현금영수증 소득공제 안내 [Web발신]

[국세청] 근로자는 현금영수증 발급 시 이용한 휴대전화번호를 등록하여야 소득공제 혜택을 받을 수 있습니다.

★ 2019년 1월부터 10월까지 귀하의 휴대전화번호로 발급된 현금영수증이 32건 있으나, 휴대전화번호 등록이 되지 않은 상태이므로 사용내역이 귀속되지 않았습니다.

★ 소득공제 혜택을 위해 조속히 등록하여 주시기 바랍니다.

★ 휴대전화번호 등록 방법

1. 홈택스 홈페이지 : 로그인> 조회/발급> 현금영수증> 현금영수증 발급수단

2. 모바일 : 홈택스 앱> 로그인> 조회/발급> 현금영수증 발급수단

3. ARS : ☎126> ①홈택스> ①현금영수증> ①한국어> ②휴대전화번호 등 사용자등록서비스

4. 보이는 ARS : 최신버전의 홈택스 앱 설치> ☎126> ②보이는 ARS> ① 홈택스상담> ①현금영수증> ①한국어> ②사용자등록

★ 휴대전화번호를 등록한 다음날부터 현금영수증 사용내역을 조회할 수 있습니다.

★ 놓칠 수 없는 현금영수증 소득공제! 다가오는 연말정산 미리미리 준비하여 절세하세요!

While it seems there is nothing we can do about those 32 instances of cash receipts that have already occurred earlier in this year, the text message gives several options on where to register your phone number so we can get credit for future cash receipts. #1 is through their website, #2 is through their mobile app 홈택스 앱, #3 is via an automated phone call called ARS verification or authentication, which is normally used in conjunction with an OTP stick or banking security card, and #4 is ARS used with their app.

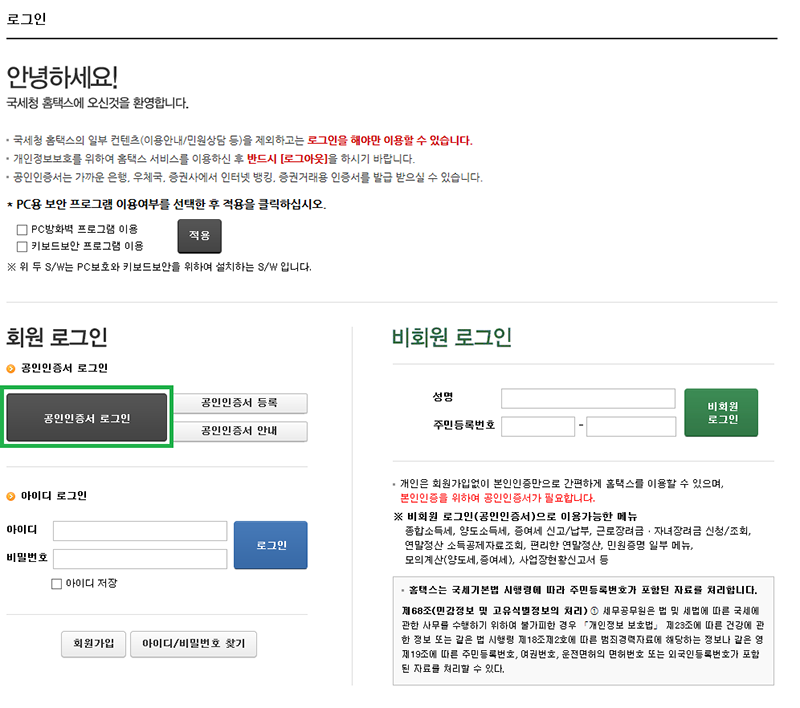

Options #1, #2, and probably #4 require a digital certificate (공인인증서, 公認認證書, gongininjeungseo) is an electronic certificate stored on a smartphone, hard drive, and/or USB stick. Even if you have a security card or OTP, you will not be able to do electronic banking without one of these and you will also be unable to file your taxes. Before you start any of the steps mentioned in the text message, either get your digital certificate or make sure you have it on the device (PC or smartphone) you plan to visit the tax office with.

Even if the digital certificate is valid, it still needs to get registered on the tax website or their app, whichever you wish to use for the process. This seemingly unnecessary step was found to be more difficult on a smartphone, so we’ll give directions below on how to register your digital certificate on their website and then register your phone number.

Let's start by going to the National Tax Service wesbite (https://www.nts.go.kr). For this step and all others, if you want to see the words more clearly, click the picture to see a larger version of the screen capture. Here is the Home Tax website (국세청홈택스, 國稅廳 home tax, guksecheong hom taekseu. We are going to register our digital certificate, so let’s click on the Digital Certificate Center button (공인인증서센터).

Within the Digital Certificate Center button (공인인증서센터), as we already have our digital certificate, we’re going to register it with the tax agency by clicking on 공인인증서 등록 (公認認證書 登錄, gongininjeungseo deungnok).

We need to select between an individual (개인, 個人, gaein)and a business (사업자, 事業者, saeopja). Assuming you are an individual, go under 개인 and add your Residence card number. Remember it is birthday first, and as that information is not regarded as secret, it will not be hidden. When you are finished, click the button under it marked 등록하기 (登錄, deungnok hagi).

A popup will appear. You may need to download a security program to continue. If so, you’ll see a little downward pointing arrow (not shown) over some of the icons. Select the location of your digital certificate, enter the password, and click the 확인 button.

Now that you have registered your digital certificate, you can login with it. Under 회원 로그인 (會員 login, hoewon rogeuin) click on 공인인증서 로그인 to indicate you will login with your digital certificate.

You’ll see the same popup as you used to register your digital certificate. Enter your password again and click the 확인 button. Then the popup will disappear and you’ll see the main page. If everything worked, you’ll see your name at the top of the page to the left and on the right you'll see a blue button marked 로그아웃, which is phonetically “logout”.

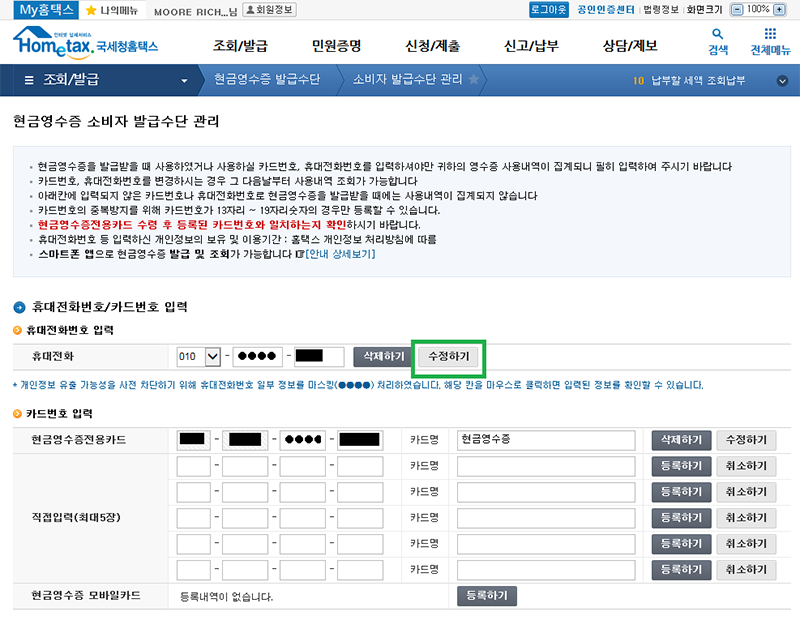

We’re going to click several menu options, simply follow along with what has been shown in the green boxes.

Enter your phone number and click the button marked 수정하기 (修正하기, sujeonghagi) to register or update your phone number. If you have a cash receipt card, you’ll see it shown below. You are all done. You may now logout of the website.