This is a quite step-by-step tutorial on how to file for the year-end tax settlement in Korea. Contents, including all screen captures, were recorded in January 2022 for the 2021 tax year. All images on this page are copyright National Tax Service.

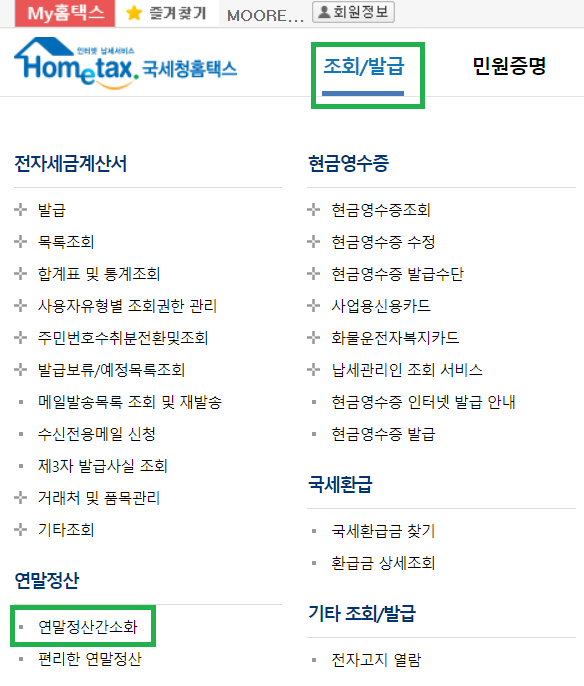

Visit the National Tax Service website. The welcome screen looks like this. Click the left option 연말정산간소화 (年末正史簡素化).

This is the login screen. Put your name (성명) and Resident Registration number (주민등록번호) and then select an authorization method, either digital certificate issued through a bank (공동-금융인증서 로그인) or alternative login method (간편인증 로그인). Regardless of the method you select, you cannot proceed without filling in your name and Resident Registration number.

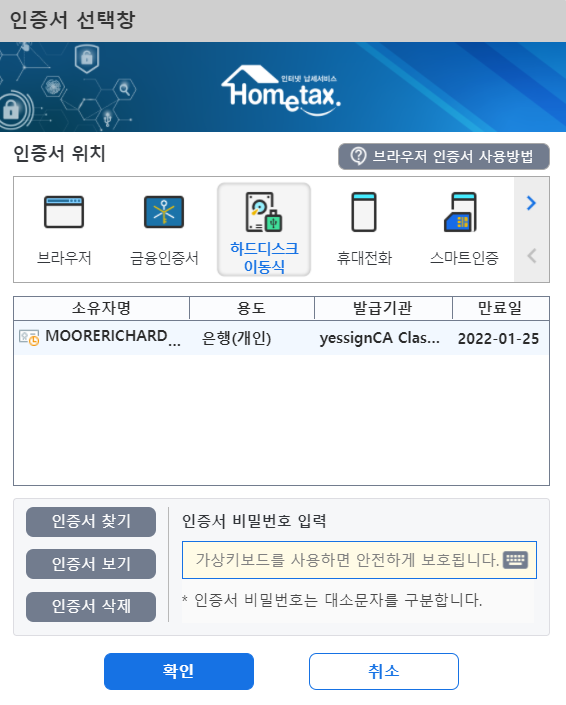

If you selected the digital certificate, this is the popup you will see. Select the location of your certificate, select it, enter your password, click 확인.

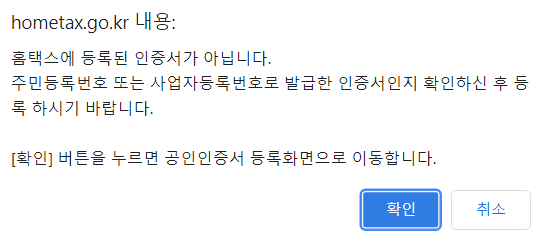

If the certificate has not been registered, you will get a popup telling you it needs to be registered before you proceed. Click확인.

Click the large button labeled 공등-금융인증서. Enter your digital certificate again to register it.

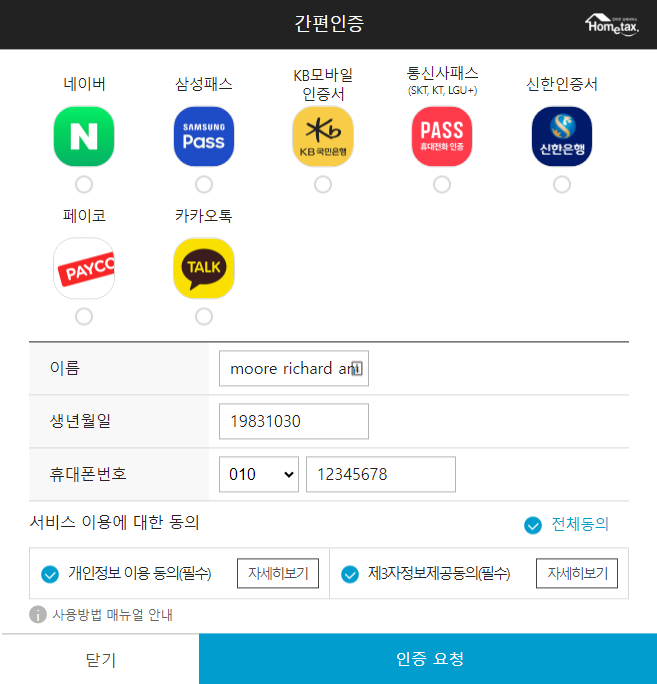

If you are logging in via an alternative login method, this is the popup you will see. The login options change their order randomly. Select the authenticator, for example Naver or Kakao. Your name and date of birth will be the same as the previous screen. Add your phone number and agree to the terms and conditions. Click 인증 요청.

If you are filing taxes as an individual 개인, put your Resident Registration number under 개인 and click 등록하기. If you are filing taxes as a company (사업자(개인-법인-세무대리인) fill in your business number (사업자등록번호) and click 등록하기.

You will get bumped to the main page.

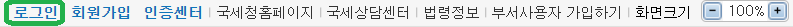

Click the login button (로그인) at the top of the screen.

You will see a familiar screen. Click the large button labeled 공등-금융인증서. Enter your digital certificate again to log in.

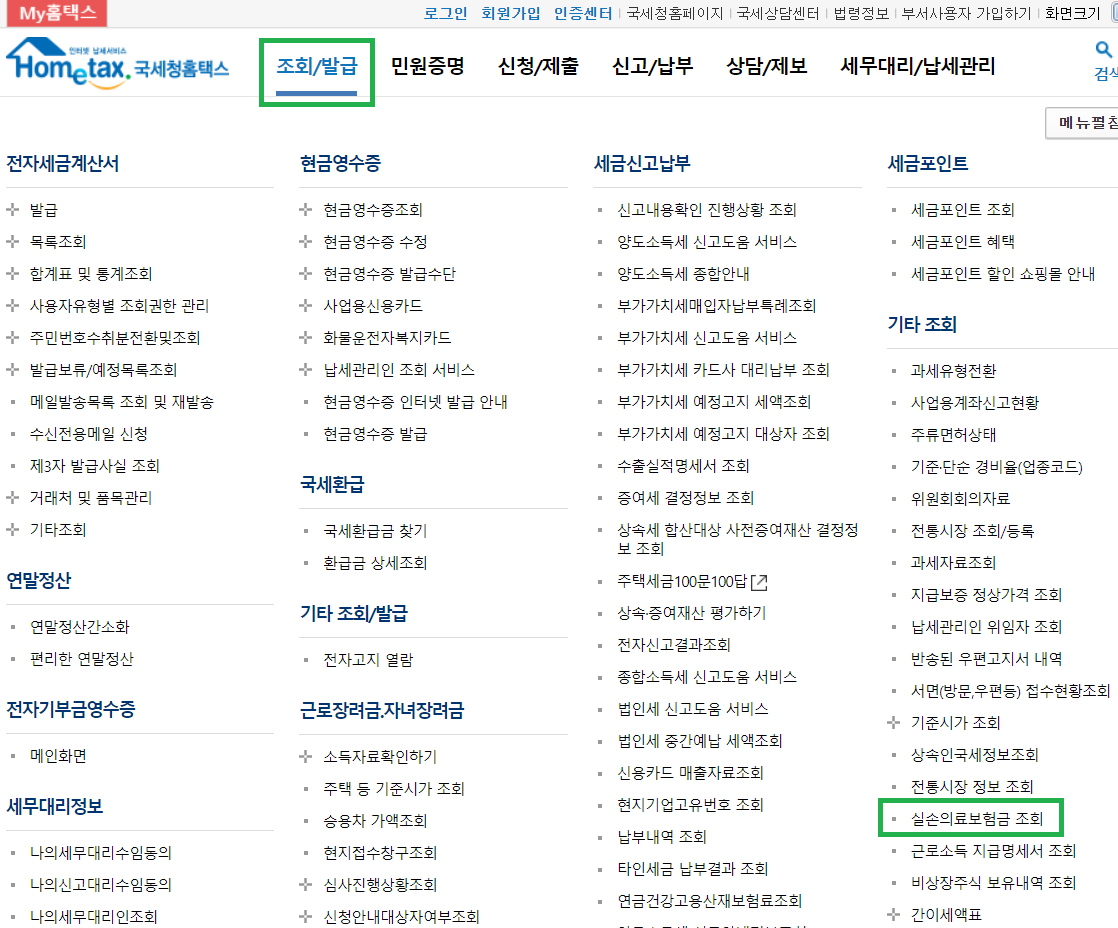

If you want to get credit for third party health insurance (not 4 Social Insurances) click 조희/바급 and then click 실손의료보험금 조희.

If you paid for third party health insurance, it will be shown here. In this example, Richard did not pay for third party, so nothing is displayed.

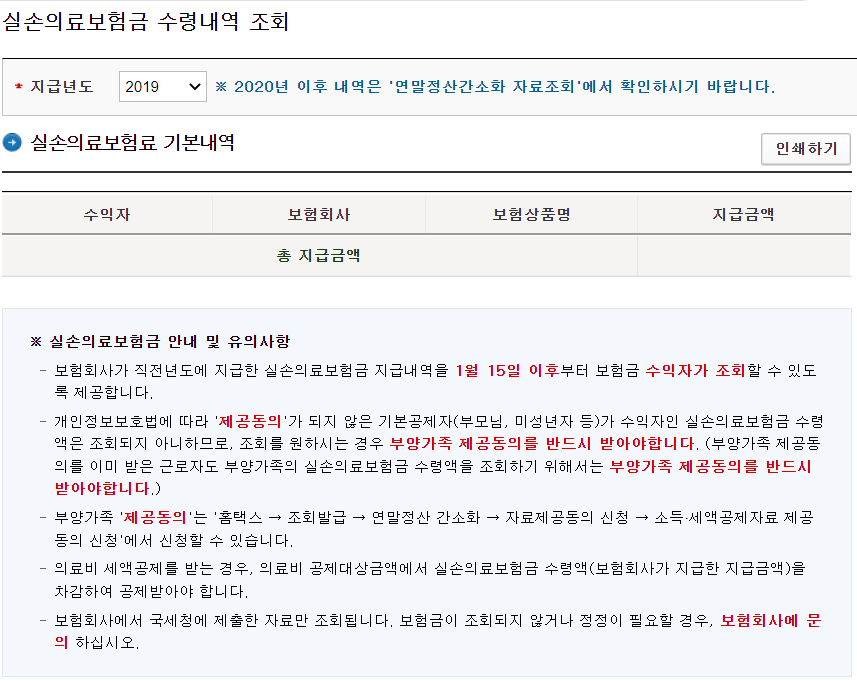

Now let’s start the actual tax filing. Click 조희/바급 and then click 연말정살간소화.

Click 조희(근로자).

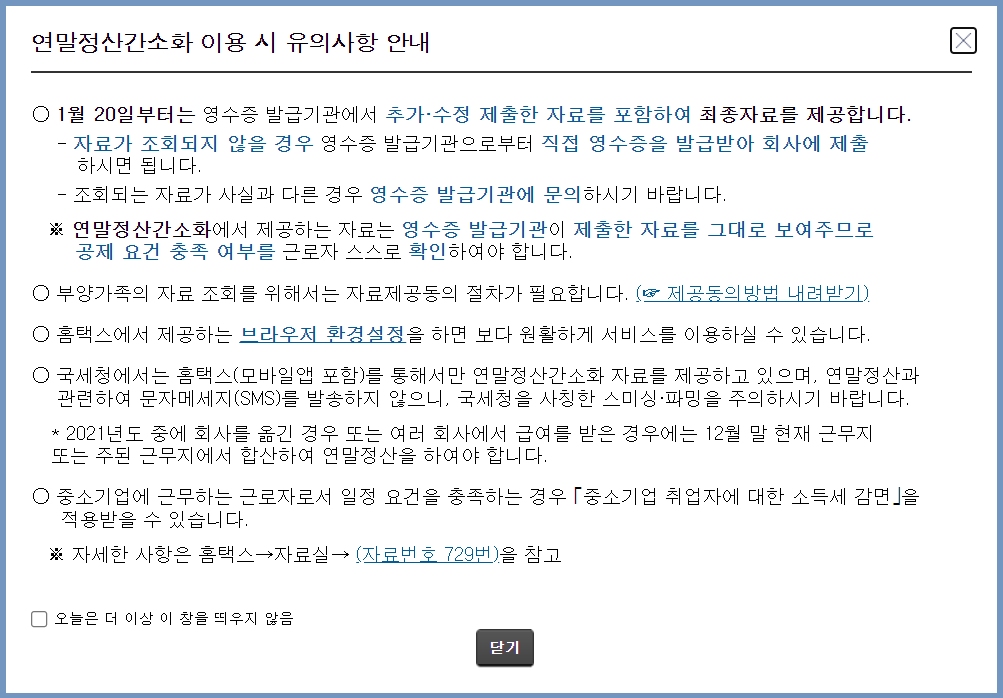

You will see a popup. In part, this mentions that if you don't get credit for something, you can manually add it.

This is the main screen you will deal with for the majority of the process. In the sample we see 2021 is auto selected from the drop-down menu. If filing in January or February 2022, you are filing for tax year 2021. You can select the drop-down for previous years.

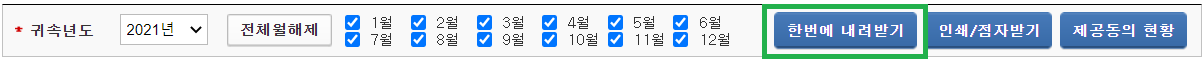

Next to the year are two boxes that are selected. 1월 is January, 2월 is February, etc. They should all be selected automatically. If any are not selected, you will not get tax deduction credit for the unselected months.

There are 14 large blue boxes, each bilingual. Click them one-by-one and they will display the amount of applicable deductions within the blue box. Under the boxes you can see the details and have the ability to unselect anything.

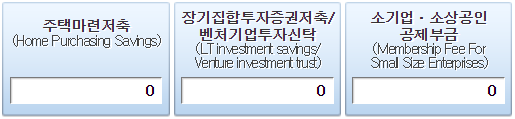

If a zero is shown within any of the boxes, it means you will not receive any credit for that category.

After all of the 14 large blue boxes have been clicked, click the button labeled 한번에 내려받기 which is located next to the months.

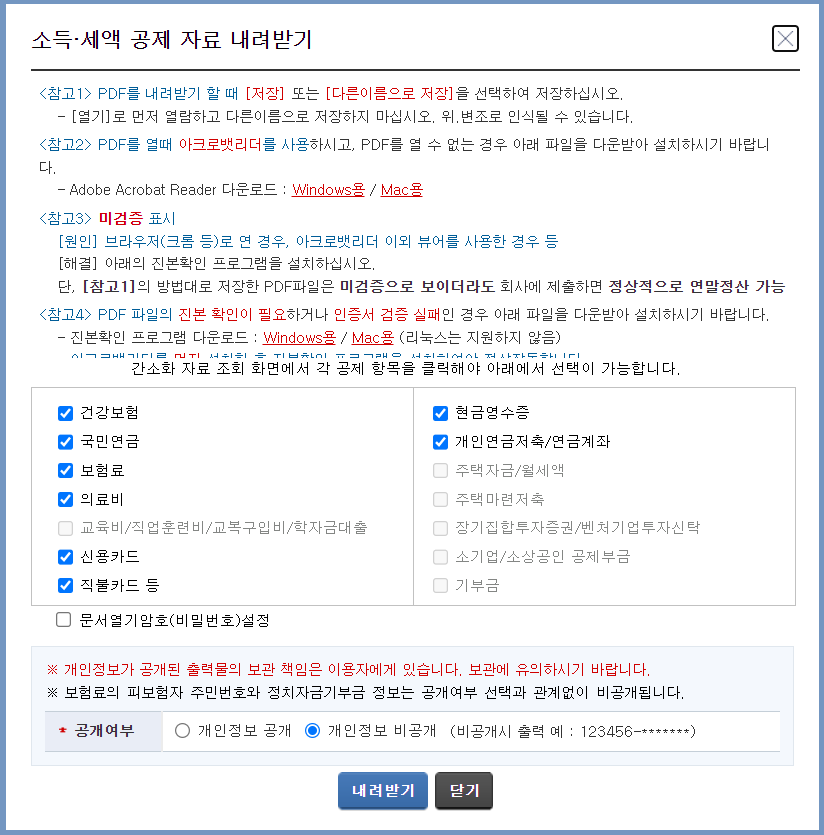

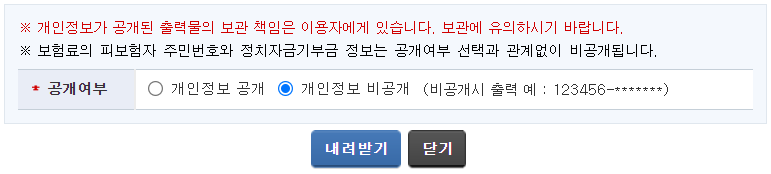

A popup will appear. This tells you your taxes will be downloaded in PDF formal and gives a few options.

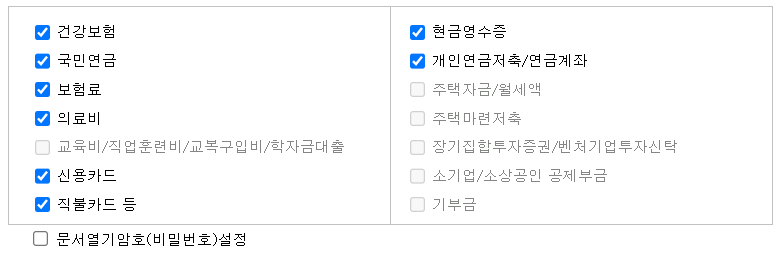

The 14 blue boxes are monolingual and displayed vertically. If you have any deductions in a given category, there will be a checkmark next to it. If there is zero value, it will be in gray scale. Directly beneath is a box not selected with the words 문서열기암호(비밀번호)설정. If you want the PDF to be password protected, select this box.

There is another set of options. The left (개인정보공개) means your Resident Registration number will be fully displayed in the PDF. The other option (개인점보 비공개 (비공게시 출력 예 : 123456-*******)) means your Resident Registration number will be halfway replaced with asterisks. This second option is automatically selected. At the bottom is a blue button labeled 내려받기, click it to download the PDF.

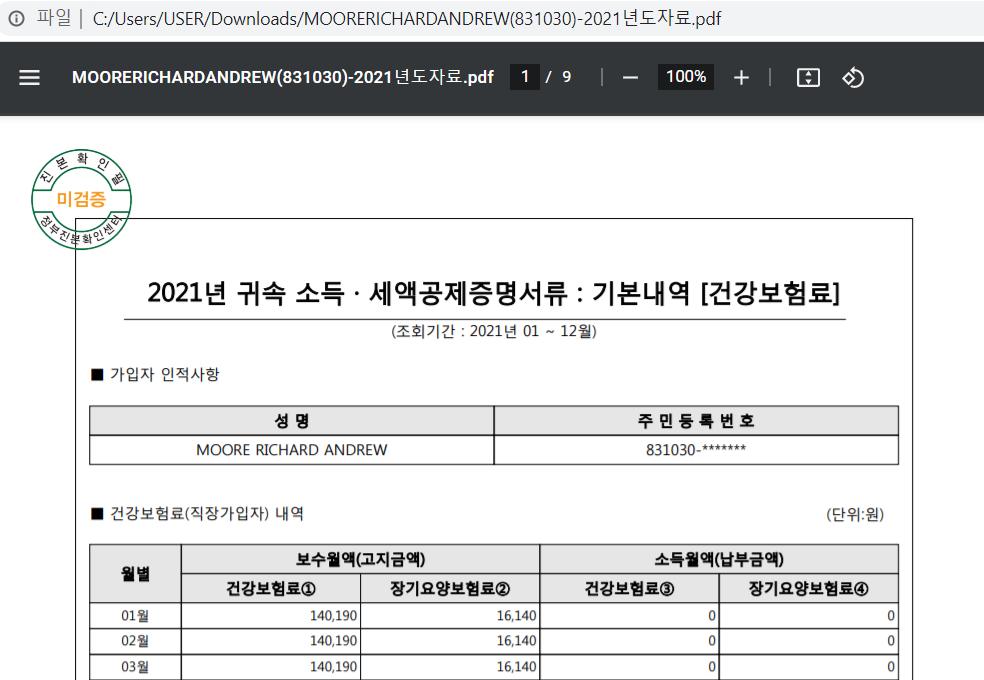

The PDF of your taxes should have downloaded. The information presented on the website is now in PDF format. Keep this file in a safe place.

Log out from the website by clicking the button labeled 로그아웃.

A popup confirms you wish to log out. Click 확인.