The National Pension Service (NPS) (국민연금공단, 國民年金公團, gungmin yeongeum gongdan) and was established in 1987. Compulsory coverage was extended to workplace-based international residents in 1995. Out of the four social insurances in Korea, this is one you'll typically get info on when you just arrive and are prepared to leave Korea. Most working age Koreans and foreign nationals between the ages of 18 and 60 living in Korea are subject to participating in Korea’s pension system. If you are employed by a company, you will be categorized as a workplace-based. All other individuals subject to the program are individually insured. National Pension Service contact information is located here.

The following international residents are not subject to coverage of Korea’s pension system. Information has been copy-pasted from the National Pension Service website and with with additional information here. The list below is current as of July 2020.

- Via reciprocity, foreign nationals from the following countries: Republic of South Africa, Nepal, Maldives, Myanmar, Bangladesh, Vietnam, Saudi Arabia, Armenia, Swaziland, Ethiopia, Iran, Egypt, Tonga, Pakistan, Fiji, Cambodia, Singapore, Belarus, East Timor, Georgia, Nigeria, Malaysia (22 countries).

- Foreign nationals who lack an Residence Card or who have been ordered by the Korean government to leave Korea.

- Foreign nationals who overstay their Korean visa without permission.

- Foreign nationals who have one of the following visas: D-1, D-2, D-3, D-4, D-6, F-1, F-3, G-1.

- Foreign nationals who are not subject to NPS coverage due to a social security agreement or some other treaty (e.g. Iran).

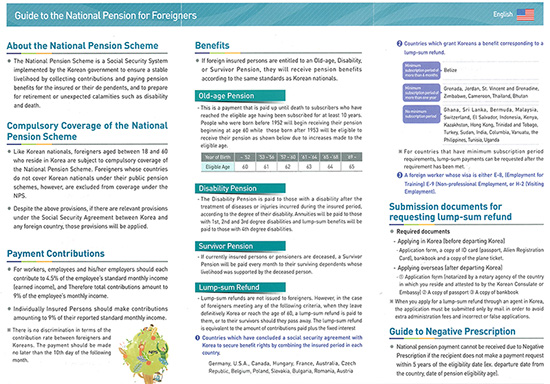

A good detailed overview of the penion system is this 60-page PDF (45 megabytes). A quicker overview is viewable in this 2018 flyer in PDF format. Scans of another flyer with dates unknown are viewable below. If you want to see either of the images more clearly, click one to see a larger version.

The National Pension System pays contributors in five methods. Even if someone is eligible for two or more categories, (including a Lump-sum Refund), only one benefit shall be paid in accordance with his/her choice, and the payment of other benefits are suspended. The information provided below is largely copy-pasted from the official website with some modifications for clarity.

Old-age Pension

| Birth | Applicable ages | ||

|---|---|---|---|

| Old-age pension | Early old-age pension | Divided pension | |

Disability Pension

The Disability Pension is provided to a person having a physical or mental illness even after being treated for the disease or injury which came about during his/her insured period. The Disability Pension is paid while the beneficiary has the disability, and the benefit level is determined on the severity or conditions of physical or mental illness. If a person, who is or was insured, has a physical or mental disability due to a sickness or injury, and meets all the following qualifications related to the first medical examination date and contribution payments. However, in the case when the first medical examination related to the sickness or injury took place prior to November 30, 2016, the Disability Pension will be paid only for the concerning sickness or injury that occurred during the insured period.

| First medical examination date | Pension contribution payments |

|---|---|

|

|

Survivor Pension

The survivor pension is designed to guarantee the income of spouse and eligible family members, whose livelihoods had been maintained by the deceased, when the insured person dies. The survivor pension amount consists of the sum of the DPA and 40% to 60% (depending on the insured period) of BPA.

| Death prior to 30 November 2016 | Death after 30 November 2016 |

|---|---|

|

|

Lump-sum Refund

A lump-sum refund is payable when a person can no longer be covered under NPS because of age, emigration or death, etc., while fails to qualify for benefits. Benefits are given when a person who is or was an insured person comes under one of the following conditions, a lump-sum refund is paid:

1. In the case when a person who had been an insured person for less than 10 years reaches the age of 60 (except for the special old-age pension beneficiaries)

2. In the case when a person who is or was an insured person dies but there is no survivor who is eligible for a survivor pension

3. In the case when a person loses his/her nationality or immigrates* to a foreign country

※ The age for lump-sum refund (in the case of 1) is adjusted as follows;

People born between 1953 and 1956: 61 years of age

People born between 1957 and 1960: 62 years of age

People born between 1961 and 1964: 63 years of age

People born between 1965 and 1968: 64 years of age

People born in 1969 and beyond: 65 years of age

Lump-sum Death Payment

When a person who is or was an insured person dies, but there is no eligible survivor for a Survivor Pension or Lump-sum Refund, as referred to in Article 73 of the National Pension Act, a Lump-sum Death Payment is paid as a funeral grant to a broader range of survivors.

When a person who is or was an insured person dies, leaving no survivor eligible for a Survivor Pension or Lump-sum Refund, the Lump-sum Death Payment is paid to a person with the priority in the order of 1. Spouse 2, Children 3, Parents 4, Grandchildren 5, Grandparents 6, Siblings 7, Collateral blood relatives within first cousins, and whose livelihoods were supported by the insured person.

The amount of a Lump-sum Death Payment corresponds to the Lump-sum Refund for a person who is or was an insured person, not exceeding four times the larger amount of either the final Standard Monthly Income of a deceased insured person or the average of the Standard Monthly Income during the insured period. In this case, the Standard Monthly Income is adjusted to the value one year prior to the benefit payment.

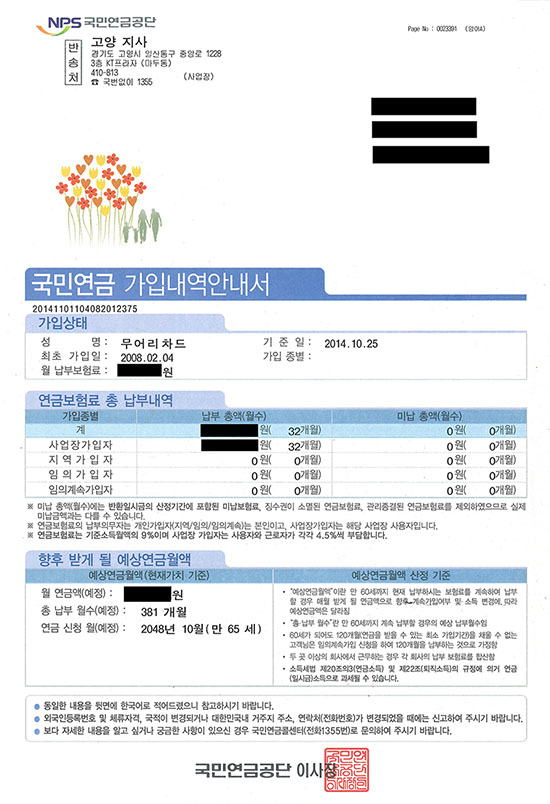

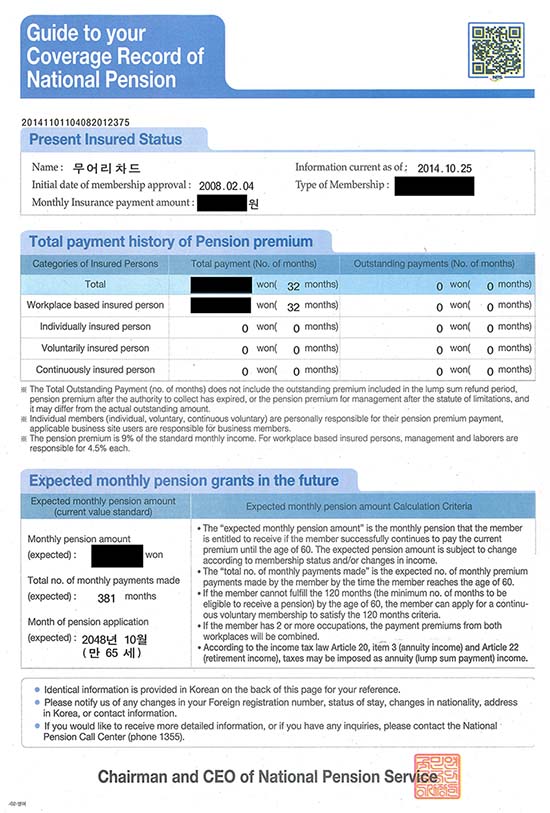

From early 2020, the National Pension Service no longer sends out physical paper-based statements showing the status of your pension contributions. The English version of their website has a section where you can check your pension status. However, the page it leads you to is only in Korean. The process also requires a digital certificate, which is also required for access to digital banking and tax settlement. Going paper-less is estimated to save the Service over billion won annually.

The physical statements came in envelopes like the one shown below. If you want to see either of the images more clearly, click one to see a larger version.

The physical statements were very simple double sided single document with Korean language on one side and English on the other. If you want to see either of the images more clearly, click one to see a larger version.