If you created a digital certificate with one bank, but wish to use to with another bank as well, you’ll need to register it at the second bank. The process is similar to making the original certificate, so you’ll see some overlap in the steps. While we made the certificate at Shinhan Bank, we’re going to register it at KEB Hana. These two banks were selected as the author has accounts with them which makes it easier for him to use their sites for examples. The Institute for Basic Science is not endorsing them and we also are not receiving anything from them for using their sites as examples.

You’ll need multiple items to complete this process. Make sure you have them all before you start otherwise you’ll just be wasting your time. Residence Card, bankbook/passbook or at least your bank account number, your PIN, a security card, a smartphone or basic mobile phone which can receive calls and/or text messages, and you may need to talk to the bank ahead of time to tell them to enable online banking for your account.

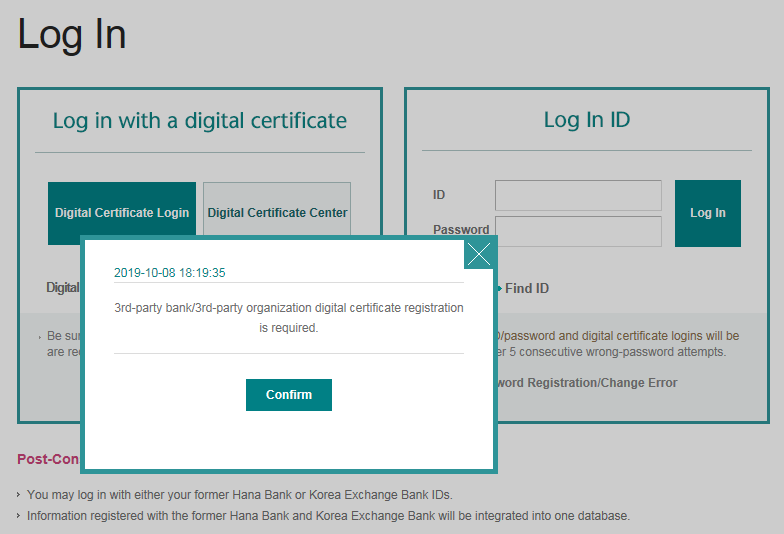

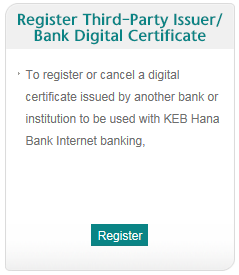

Here is the related button you need to click on with KEB Hana. For simplicity, we are just showing you the one related button.

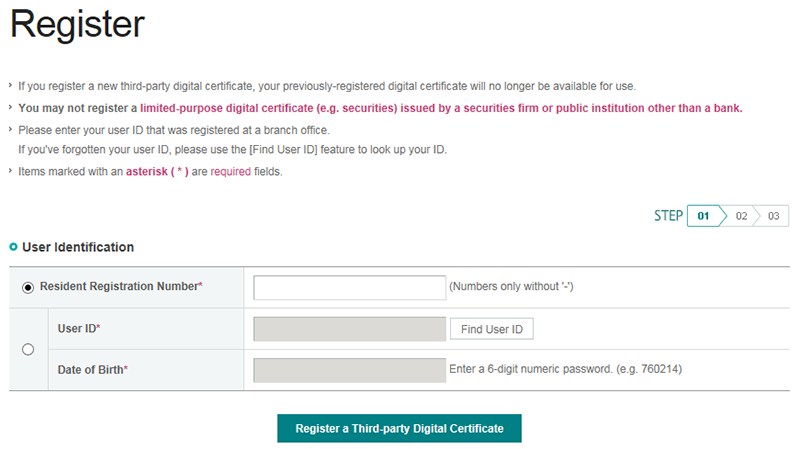

This site gives us an option, Residence Registration card number, shown as Resident Registration Number which technically is the term for Korean citizens but your Residence number will still work, and the other option is your login ID and date of birth.

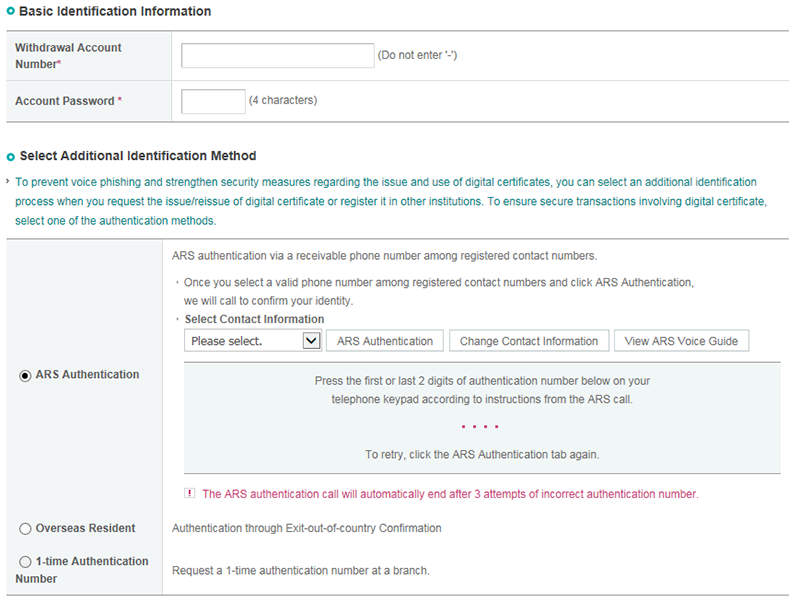

Withdrawal Account Number is simply your account number. The translation is a little off as we aren’t withdrawing funds, but simply stating our account number. If you have a bankbook/passbook you can get the number from the first page of that. Account Password is your PIN.

The next part can be done with a phone but they only have the ARS option, meaning the bank will send you an automated call and tell you to type in certain numbers to confirm you are you. For the time being they are not offering the ability to do this via SMS (text message). If you don’t have a phone, you can go to a physical branch.

Those two options work well if you are physically in Korea, but these don’t work well if you are overseas, especially for an extended period of time. That is why KEB Hana, and some other banks as well, provide a special option for those currently overseas. In the example shown below, it is written as Overseas Resident. If you select this option, you are providing the bank permission to electronically contact Korean Immigration and check to see if you left the country or not.

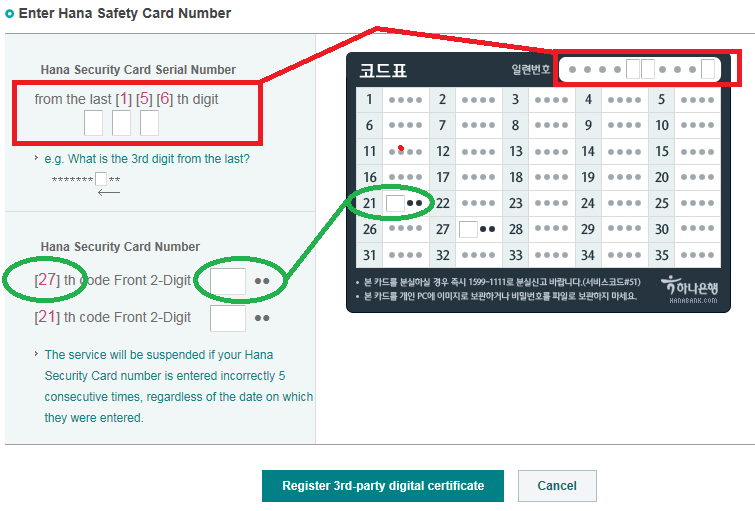

Now you will need your security card. The front of the card is generic, and the rear side of the card has numbers your need. Flip over the card and we’ll first need some digits from the top right side of the card. The wording on some websites is confusing, so we put a red rectangle to highlight this part. Note that by typing in numbers, these boxes are displaying a black circle to show it is filled. Also note the mouse icon, so you can input these numbers with your mouse, if desired.

Now we’ll need two sets of numbers from specific lines. On this occasion, the banking website is asking for the first two numbers from the 6th line, as shown in the green circle, and the last two numbers from the 8th line.

This is the only time you’ll need these digits on the top right corner but you will need numbers from specific lines when paying for online purchases or doing an online wire transfer. Some people take a picture of the reverse side of their security card so they don’t need to bring this physical thin plastic card with them so it is within their smartphone accessible whenever needed. If your phone has a password, this can be a nice option as the numbers on your security card are protected by your mobile password, but this also creates a vulnerability as anyone with access to your phone could access the numbers of your security card.

Unfortunately, this is not theoretical as there have been instances in which someone’s account has been hacked and money stolen electronically. During at least one investigation, it was discovered that the victim had a picture of their security card stored within their smartphone. The court has ruled that based on this lapse in security done by the victim, the bank was not responsible for the breach and related theft and therefore was not responsible to repay the stolen funds to the victim. With this in mind, we highly recommend you do not store an image of your security card in your phone or anywhere else.

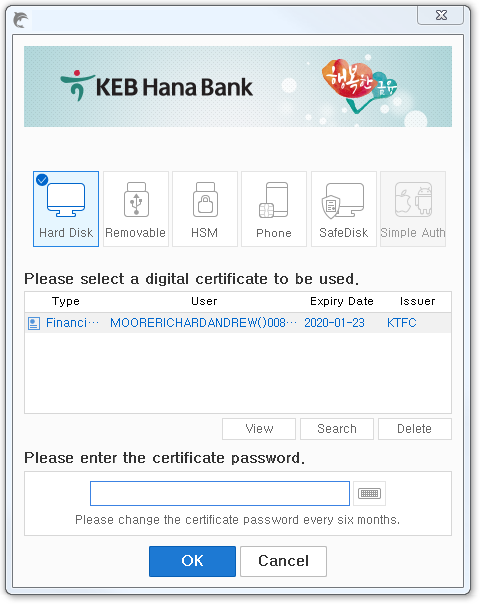

Next you’ll select your digital certificate, enter the password, and should get a confirmation message that it is now registered. Once this is done, you should be able to log in to the website.