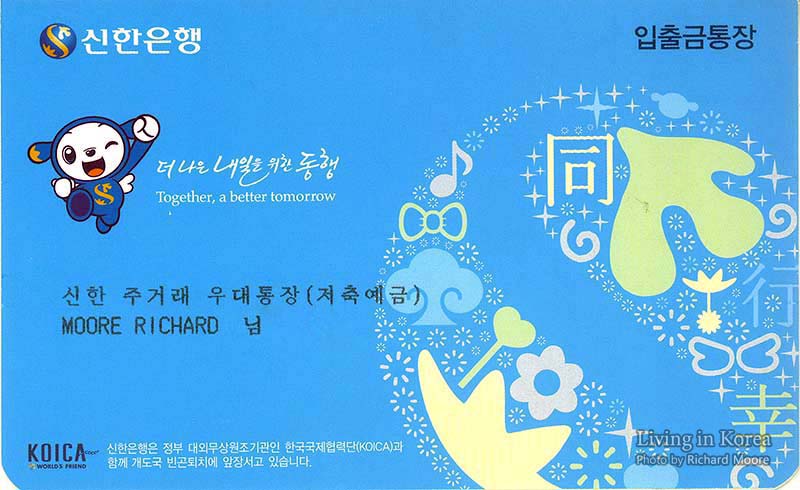

Frequently translated as bankbooks or passbooks, 통장 (通帳, tongjang) are small paper booklets 14 cm wide by 8.5 cm tall. These are small enough to fit into your pocket but too big to fit inside a wallet. While bank checks do exist, Korea does not have personal checks. These bankbooks serve the same purpose as balancing a checkbook; they show all transactions and the running total. They are not updated by hand but by placing them inside of ATMs or special printers that tellers have. While usage is on a downward trend due to smartphones and internet banking, these books still remain in common usage. They are free to get and use but might change in the future when banks make a push for digitial records over paper.

Banks will rarely change the design on the front except for a special event, such as the 2018 Winter Olympics. KEB changed their covers during this period.

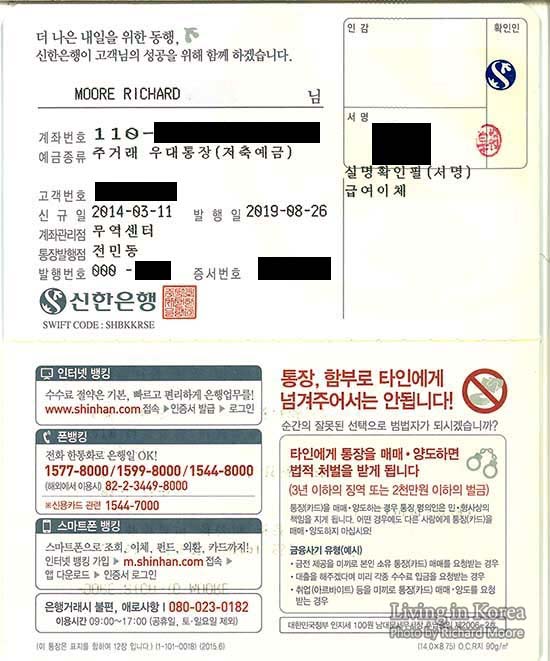

The first page shows banking information, including your name and account number. You'll need to add a signature to the right and will then get covered by a sticker so it cannot be modified.

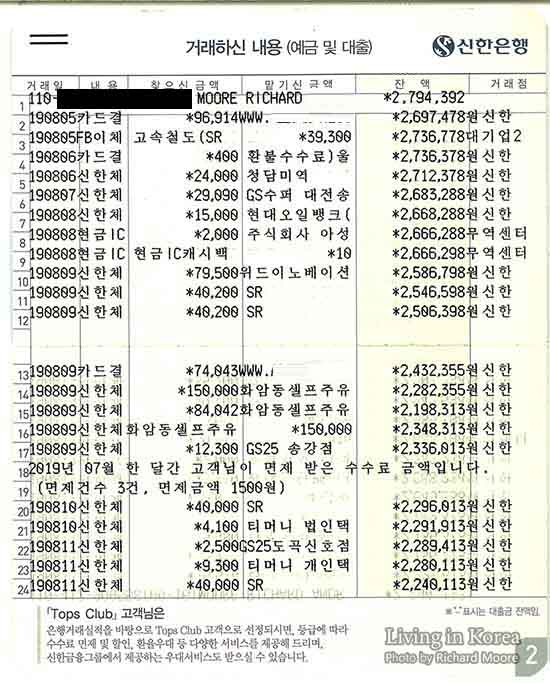

The ten pages in the middle show transactions, frequently 25 per page. Information in the columns are date, bank, charges, credit, running balance, and sometimes another field. If there is a charge then the next column will show the vender. If your account receives a credit, the previous column will show the sender. When you send money to another account online or via some bank apps, you'll have the option to change the name into a memo so you can more easily remember the transaction.

The last page will have additional bank information or be open for handwritten memos. The rear of the book will have a black or dark colored magnetic strip. If you lost a bankbook or have filled all pages, you will need to meet with a teller to get a new one issued. The magnetic strip on the rear side is usually discarded and you can keep the old bankbook for your own recordkeeping purposes if you wish.

Some banks don’t want to spend the money on ink and paper if their customers don’t seem to use their bankbook. This in mind, if you don’t get your bankbook updated at an ATM within a month or two the bank may omit a number of the charges and credits when it prints the transactions. Even though they will not be displayed in your bankbook, they will be available online and via their smartphone app.

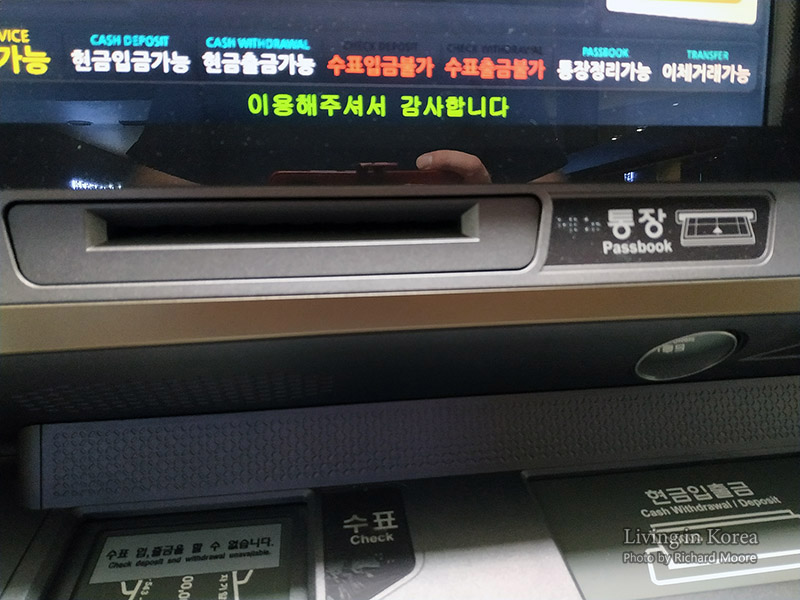

To update a bankbook, you’ll need to find an ATM from your bank. Don’t expect another bank brand to work and don’t expect a no name ATM you find in a convenience store to update your bankbook. Locate the wide opening, open your book and insert it open side up to the current page.

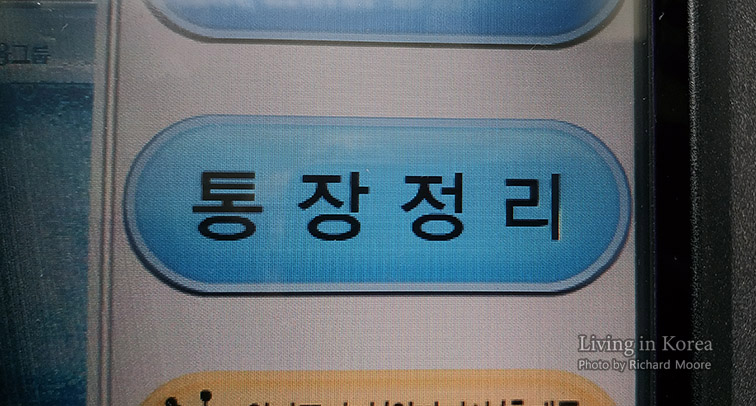

English menus will frequently mention “passbook update” but terminology might differ. It may be easier to select the option in Korean, 통장정리 (通帳整理, tongjangjeongni) which is on the main menu screen. When all transactions have been printed, or if all pages are full, it will eject the bankbook. If several pages need to print, don’t worry about manually turning the pages as the machines can easily go to the next page.